Why Every Delhi Startup Needs a Dedicated Tax Advisor

Delhi has rapidly emerged as India’s startup capital, with thousands of new businesses registering every year. The city offers unmatched infrastructure, access to skilled talent, and proximity to government and regulatory institutions. However, with this advantage comes a complex business environment filled with regulatory obligations, tax laws, and financial compliance challenges.

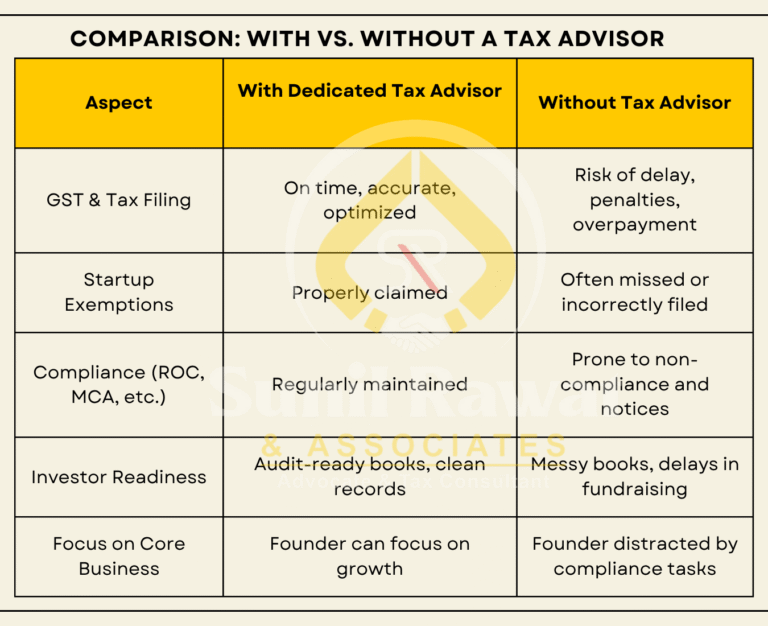

Most startup founders are focused on product, growth, and funding—and understandably so. But without the right tax guidance, even the most promising venture can run into legal roadblocks, cash flow issues, or investor trust deficits. That’s why having a dedicated tax advisor from the beginning is not optional—it’s a strategic necessity.

1. Navigate Complex Tax Laws with Confidence

Indian tax laws are vast and constantly evolving. From Income Tax and GST to TDS and advance tax, a professional tax advisor ensures your startup:

Understands and meets all legal obligations

Avoids penalties and late filing fees

Keeps books compliant with Indian regulations

2. Maximize Early-Stage Tax Savings

Startups run on lean margins. A qualified tax consultant helps you:

Claim startup exemptions (like Section 80-IAC)

Optimize GST input credits

Reduce tax outgo through proper planning

These savings can directly support business growth in your initial years.

3. Prevent Costly Compliance Errors

Missing deadlines or filing incorrect returns can attract notices, penalties, and audits. A dedicated advisor ensures:

Timely GST, TDS, and Income Tax filings

Proper financial record maintenance

ROC and MCA compliance for registered entities

4. Essential for India Entry & Foreign-Funded Startups

Planning to raise international funds or enter India as a foreign startup? A tax advisor helps with:

Structuring your business legally and tax-efficiently

Managing transfer pricing and withholding tax

Ensuring FEMA and FDI compliance

5. Critical for Fundraising & Due Diligence

Investors expect clean books and compliance readiness. A tax advisor prepares your startup to:

Pass financial due diligence smoothly

Present accurate projections and filings

Build trust with potential investors

Why Hire a Delhi-Based Tax Advisor?

Local matters. A Delhi-based expert:

Knows local tax offices and startup laws

Offers quick in-person support when needed

Understands Delhi-specific schemes and incentives

Conclusion: Tax Guidance is Business Guidance

A dedicated tax advisor isn’t a cost—it’s a smart investment. From saving money to ensuring legal peace of mind, the right advisor becomes your startup’s financial backbone.

Need expert guidance for your Delhi startup?

Contact Sunil Rawat & Associates for professional tax, compliance, and advisory services tailored for new-age businesses.

A Few Of Our Clients